Covid-19 is considered as an agent to change the position of ed-tech (education technology), fostering the process of the technological nation of the global education industry. However, foreign startups still dominate the game in the Vietnamese market.

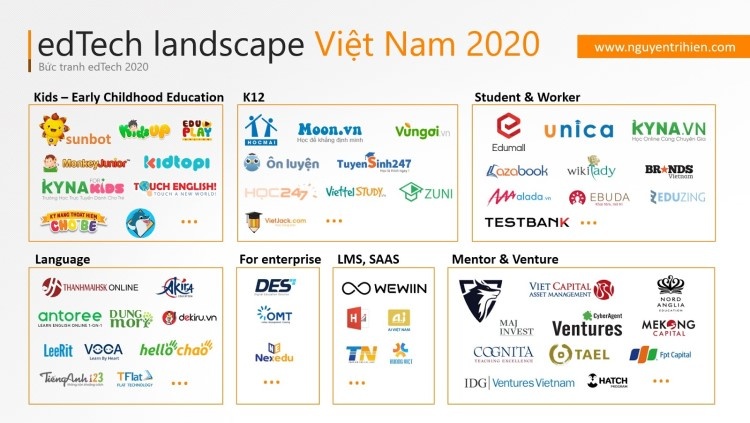

Vietnam’s EdTech landscape 2020 (source: nguyentrihien.com)

Over 1,200 investment transactions in the ed-tech domain with a value of 36.38 billion USD were made in 2020, according to research by Mr Nguyen Tri Hien, co-head of the ed-tech village at Techfest 2020. Global mobile teaching and learning have grown at a rate of 36.45% to a value of $27.32 billion. In which, the United State, China, India and Korea are the leading countries and focus on digital transformation in the education industry. At the beginning of this year, an Indian startup in the ed-tech industry, Byju received $ 450 million in funding from a venture fund.

In Vietnam, the ed-tech market has entered the 5th stage, when online teaching and learning has become popular with everyone. Last year, the number of investments poured into the market was up to $45 million, not to mention the tacit investments that have not been statistically. It is estimated that the ed-tech market will be worth up to $4 billion by the end of 2021, according to research by Mr Hien.

While society is affected by Covid-19, some English centers have shown agility in adapting to the situation of limited contact. The number of orders for short-term online courses at Edu2Review has increased 100% since last year, said Austin Carter, founder of Edu2Review, a course evaluation and booking platform.

Yola, Everest and Manabe are also salient names in adapting to the new state with products that combine online and offline models. And Classin, Elsa and Tesse stand out in the products in the B2B market.

Poor funds because of less diversity

Along with the development of ed-tech in Vietnam is the appearance of foreign companies entering the market. The dominant foreign platforms in the domestic market are Coursera of the United State, UpGrad of India. Even online English learning programs come from abroad, such as Cambly, Duolingo, Hello Chao. Tutoring programs and mock exams are also mastered by SnapAsk and Clevai.

Meanwhile, domestic companies are weak due to… lack of capital. Cite as an example, only Topica ed-tech Group has just raised 50 million USD in a Series D funding round in 2018. Elsa, which received 15 million USD at the beginning of the year, has more than 13 million users worldwide following. However, Elsa has a foreign co-founder, Dr. Xavier Anguera. In addition to these two popular stereotypes, there are not many big investments in Ed-tech in Vietnam. Up to now, startups in this domain are still struggling to find capital and adapt to the market.

The reason Vietnamese companies in the ed-tech domain are less attractive to investors is that they have not introduced many products and services that are adapted to the new situation, according to Mr Austin Carter. In addition, they also lack a strategy to dominate the market. Therefore, companies need to invest in a plan to increase sales, grow over time, and products must match their tastes in order to be able to compete with foreign ed-tech giants.

The lack of diversity in the formation of products and services also prevents domestic ed-tech companies from attracting investors. Except for the majority that offers online learning programs, there are only a few companies that choose to provide technology services for the education industry. Investor Soe Moe Kyaw Oo of Nest Tech Vietnam Co., Ltd said that most Vietnamese ed-tech companies currently focus only on English training. “English training is a lucrative market, investing in this market will ensure profits for companies” – Mr Soe Moe emphasized.

Mr. Soe Moe Kyaw Oo (middle) – needs to find more startups with breakthrough products in the domain of ed-tech

The future of ed-tech

Regarding the future of ed-tech, Mr Soe Moe shared that: “The Covid-19 epidemic has promoted online learning more than before, but learners still prefer the habit of learning face-to-face with teachers. Therefore, companies need to consider when concentrating on investing in one segment. In the long term, ed-tech companies need to research and create tools to make learning more interesting and effective.”

Mr Soe Moe made a comparison between domestic and foreign startups in the industry. Kalpha, a Singaporean ed-tech startup that he invested in 2019, has launched a live streaming platform for teaching. In addition, the one-on-one teaching tool for teachers and learners on this platform has attracted 10,000 new users per month in the Ho Chi Minh City market alone. This is very rare in the Vietnamese ed-tech market.

Mr Soe Moe is looking for investment opportunities in the B2B of the Vietnamese ed-tech market, but there are not many right now. In B2C, he looks for peer-to-peer online teaching and learning models or teaching according to individual needs, but currently, those platforms do not have high traffic.

However, experts still believe that the Vietnamese ed-tech market will grow strongly in the next 3-5 years because of the Vietnamese people’s fondness for learning and curiosity. However, ed-tech cannot be expected to explode like in the financial technology and e-commerce domains, according to Mr. Austin. The amount of user data collected on the ed-tech domain is slower. This will entail the quality of product standardization for users. Next, it also takes time to get used to online and offline learning.

According to Mr Soe Moe, the Vietnam’s ed-tech market will develop sustainably, but with more research about the habit and needs of the market in order to develop suitable products for many customer segments. Moreover, startups also have to pay attention to the costs to be able to bring affordable products and still make a difference.

Source: doanhnhansaigon.vn

July 28, 2022

July 28, 2022